BTC Price Prediction: Navigating Current Market Turbulence - Is BTC a Good Investment?

#BTC

- Technical indicators show Bitcoin testing crucial support at $106,912 with bearish short-term momentum

- Mixed fundamental sentiment from Elon Musk endorsement versus regulatory actions and safe-haven narrative challenges

- Current price below 20-day moving average suggests cautious approach with defined risk parameters

BTC Price Prediction

Technical Analysis: Bitcoin Faces Critical Support Test

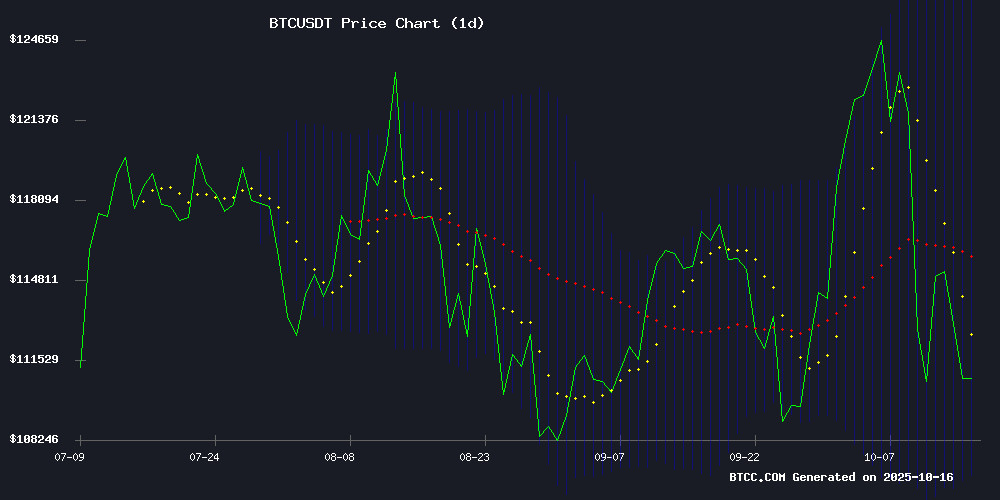

Bitcoin is currently trading at $111,598, below its 20-day moving average of $116,864, indicating short-term bearish pressure. The MACD reading of -808.78 shows weakening momentum, though the positive histogram of 1,828.52 suggests potential stabilization. According to BTCC financial analyst Robert, 'The price sitting NEAR the lower Bollinger Band at $106,912 presents a crucial support level. A break below this could trigger further declines toward $100,000.'

Market Sentiment: Mixed Signals Amid Volatility

Recent news events create conflicting signals for Bitcoin investors. Elon Musk's endorsement provides positive sentiment, while the UK court's fraud case and challenged 'digital gold' narrative create headwinds. BTCC financial analyst Robert notes, 'The market is digesting multiple fundamental drivers simultaneously. The $7.2B seizure conversion to victim compensation demonstrates regulatory maturity, but the safe-haven status challenge during gold's surge requires monitoring.'

Factors Influencing BTC's Price

Bitcoin Flash Crash Challenges 'Digital Gold' Narrative as Gold Surges

The cryptocurrency market faced a stark reality check as Bitcoin's sudden plunge from $122,000 to $102,000 within 24 hours reignited debates about its stability. Veteran economist Peter Schiff seized the moment to dismantle the 'digital gold' thesis, pointing to gold's simultaneous rally as evidence of Bitcoin's speculative nature.

Geopolitical tensions triggered the selloff, with President Trump's 100% tariff announcement on Chinese tech imports creating market-wide tremors. Binance's alleged internal pricing issues compounded the damage, accelerating liquidations across exchanges.

The volatility episode underscores a fundamental divergence: while traditional havens like gold gained during market stress, Bitcoin's double-digit percentage swings exposed its risk profile. This dichotomy raises uncomfortable questions for institutional investors seeking cryptocurrency exposure as a hedge.

Elon Musk's Bitcoin Endorsement Sparks Market Attention

Elon Musk reignited cryptocurrency discussions with a single-word endorsement of Bitcoin on social media platform X. His reply "True" to a ZeroHedge post linking Bitcoin's rally to government fiscal policies and currency debasement sent ripples through digital asset markets. The Tesla CEO's implicit support echoes Bitcoin maximalist arguments about energy-backed scarcity versus fiat currency inflation.

Market observers quickly parsed Musk's brief comment as bullish validation. The original thread posited that gold, silver, and bitcoin gains reflect monetary expansion funding the US-China AI arms race. Musk's response emphasized Bitcoin's unique energy-based proof-of-work mechanism - a quality that theoretically prevents the artificial inflation plaguing government currencies.

Tesla's $1.5 billion Bitcoin treasury position adds institutional weight to Musk's crypto commentary. While the electric vehicle maker paused Bitcoin payments in 2021, Musk's latest engagement suggests enduring interest in Bitcoin's store-of-value proposition during periods of macroeconomic uncertainty.

Trump Confirms U.S.-China Trade War, Bitcoin Reacts Sharply

President Donald TRUMP has explicitly acknowledged an active trade war with China, escalating economic tensions between the two superpowers. The confrontation follows Trump's threat to impose 100% tariffs on all Chinese imports, a move he defends as essential to protecting U.S. industries from unfair trade practices. "If we didn’t have tariffs, we would have no defense," Trump stated, framing the measures as a shield against market flooding and foreign control of critical sectors.

Global markets reacted swiftly to the heightened tensions, with Bitcoin plummeting from $121,560 to below $103,000 within hours of Trump's tariff announcement. The sharp decline underscores the cryptocurrency market's sensitivity to geopolitical instability, particularly involving the world's largest economies. Traders and analysts are now closely monitoring further developments, as the trade war could trigger prolonged volatility across asset classes.

UK Court Orders Repayment to Chinese Victims of $6.8B Bitcoin Fraud

Victims of a massive cryptocurrency scam are poised to recover funds after UK authorities seized 61,000 Bitcoin tied to the scheme. The London Metropolitan Police uncovered the stash during a 2018 money laundering investigation involving two Chinese nationals.

The fraud, orchestrated through Tianjin Lantian, promised unrealistic returns to 128,000 Chinese investors before collapsing in 2017. Prosecutors described it as a Ponzi-style operation that ultimately caused losses exceeding 40 billion yuan ($5.6 billion).

UK prosecutors are developing a compensation program to return the confiscated Bitcoin, currently valued at $6.8 billion. The case represents one of the largest cryptocurrency fraud recoveries to date.

Bitcoin’s Safe-Haven Status Challenged Amid Historic Market Crash

Bitcoin’s reputation as "digital gold" faces scrutiny after a brutal market collapse erased $19 billion in Leveraged positions within 24 hours—the largest single-day liquidation on record. The OG cryptocurrency plummeted from $125,000 to $102,000 in hours, revealing its persistent correlation with risk assets rather than serving as a hedge.

The selloff coincided with gold’s rally to an all-time high of $4,200/oz following geopolitical tensions, while Bitcoin mirrored equities’ decline. BlackRock’s $91 billion IBIT—once seen as a challenger to SPDR Gold Shares’ $136 billion fund—now underscores crypto’s unfulfilled promise as a store of value.

Market dynamics exposed Bitcoin’s continued dependence on risk appetite and leverage. "I have never considered Bitcoin a true SAFE haven," one trader remarked, as the token’s price action diverged sharply from traditional haven assets.

Bitdeer Technologies Stock Surges 29% on Strong Operational Update

Bitdeer Technologies (BTDR) saw its stock price skyrocket nearly 29% on Wednesday, dramatically outperforming the S&P 500's modest 0.4% gain. The crypto miner's rally followed an optimistic operational update released after Tuesday's market close.

The company mined 452 Bitcoin in September, a significant increase from August's 375 BTC. Bitdeer also announced mass production of its new Sealminer 3 rig series, with initial deliveries expected this month. The four-model product line strengthens Bitdeer's dual business model of self-mining and mining equipment sales.

Crypto mining stocks are enjoying renewed investor interest amid rising digital asset prices and sector expansion into data center operations. Bitdeer's vertical integration and production ramp-up position it to capitalize on these industry tailwinds.

UK Proposes Compensation for Bitcoin Fraud Victims While Retaining Bulk of $7.2B Seizure

The UK government has outlined plans to compensate victims of a Chinese investment fraud while retaining the majority of a £5 billion ($7.2 billion) Bitcoin haul seized from the perpetrators. The proposal emerged during a High Court hearing in London, where prosecutors disclosed the potential compensation scheme without detailing its mechanics.

Authorities confiscated 61,000 Bitcoin—now valued at $6.7 billion—during a 2018 raid on a Hampstead mansion, marking one of the UK's largest crypto seizures. The case has sparked a legal battle with 130,000 defrauded Chinese investors who oppose the state profiting from their losses.

At the heart of the scheme is Zhimin Qian, alias Yadi Zhang, who orchestrated a $6 billion Ponzi scheme in China before laundering proceeds into Bitcoin and fleeing to the UK under a false identity. Qian and accomplice Seng Hok Ling recently pleaded guilty to money laundering and face sentencing in November.

Did Stephen Miran's Two Rate Cut Comments Fuel Bitcoin ETF Inflows?

Bitcoin faced mild downward pressure today, but institutional demand tells a different story. Behind the price dip, Bitcoin ETF inflows suggest sustained accumulation by sophisticated investors.

Federal Reserve Governor Stephen Miran's remarks about two potential interest rate cuts may be driving this divergence. Market participants appear to be interpreting accommodative monetary policy as bullish for digital assets, particularly Bitcoin as the flagship cryptocurrency.

U.K. to Convert £5 Billion Bitcoin Seizure into Fraud Victim Compensation Fund

The U.K. government is preparing to establish a compensation scheme for victims of a Chinese cryptocurrency fraud, following the seizure of 61,000 Bitcoin (now valued at approximately £5 billion) from Chinese nationals Zhimin Qian and Seng Hok Ling. The Crown Prosecution Service confirmed it will design a restitution framework—the largest of its kind in the U.K.—after the defendants pleaded guilty to offenses under the Proceeds of Crime Act (2002).

Sentencing for Qian and Ling is scheduled for 10–11 November, with a civil recovery and compensation order expected to follow. Director of Public Prosecutions Stephen Parkinson acknowledged the government's exploration of a formal compensation mechanism, though specifics remain undisclosed. The case stems from an investment fraud that defrauded over 128,000 victims in China.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents both opportunities and risks for investors. The technical setup shows BTC testing crucial support levels while fundamental factors create mixed sentiment.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price | $111,598 | Below 20-day MA |

| 20-day MA | $116,864 | Resistance level |

| Bollinger Lower Band | $106,912 | Critical support |

| MACD | -808.78 | Bearish momentum |

BTCC financial analyst Robert suggests: 'For risk-tolerant investors, current levels may offer entry points, but strict risk management is essential. The $106,912 support holds the key to near-term direction.'